The Hunt Stops Here!

Discover How Niagara Can Check All The Boxes For Your Next Film Shoot

The secret’s out! More and more savvy location scouts are giving Niagara a starring role in their film and television scenes. With over 142 movie credits on IMDb, Niagara Falls may take centre stage when it comes to Canada’s most-filmed locations, but there’s so much more to Niagara! The Region’s unique collection of locales have film crews raving about the set potential of this scenic area that’s just a short drive from both Toronto and Buffalo, NY.

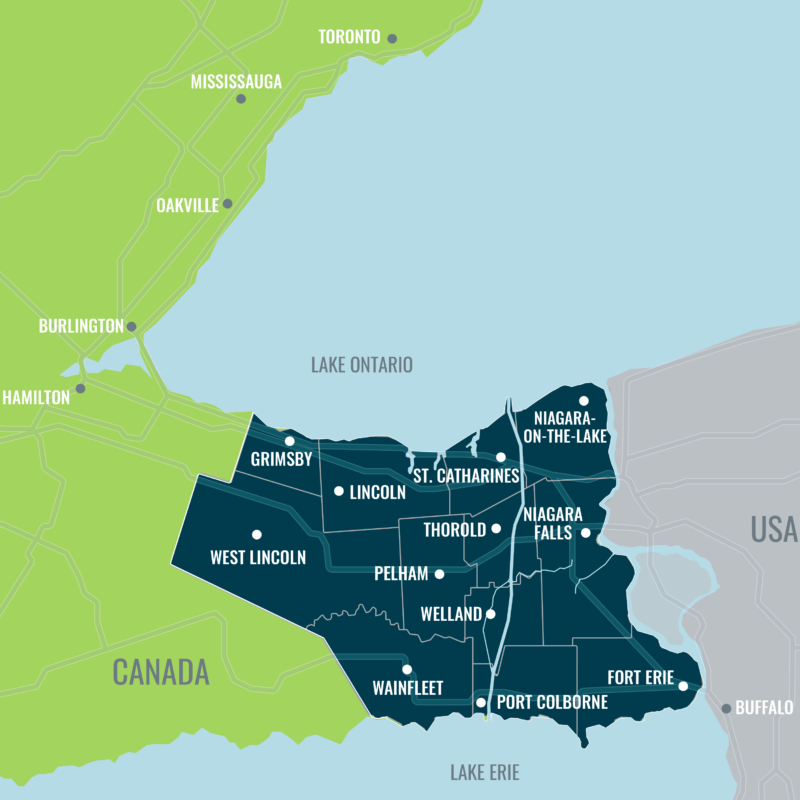

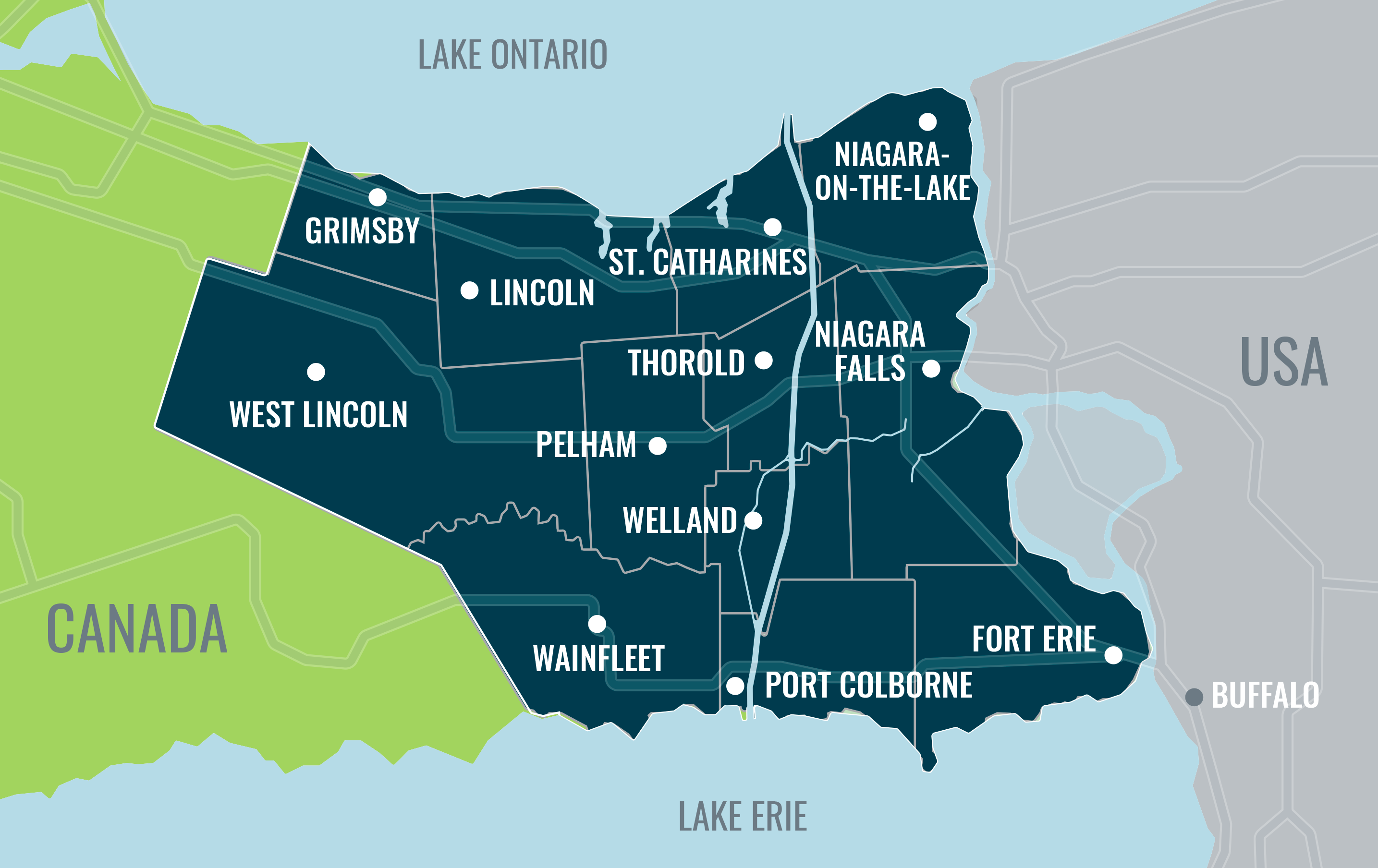

Location

From beautiful Lake Ontario and Lake Erie beaches to rolling vineyards and delightful downtown districts that can be easily adapted to accommodate period pieces, Niagara’s 12 municipalities offer an incredible range of location options with some scene-stealing cost-saving opportunities.

Recent Productions

Recent productions shot in Niagara by companies like Netflix, hulu, MGM, Universal, Touchstone Pictures, PBS, and CBC include:

- It: Chapter Two

- The Handmaid’s Tale

- The Boys

- The Time Traveler’s Wife

- The Christmas Calendar

- The Shape of Water

Take the Next Steps

Lights, Camera, Take Action!

Let our Niagara Economic Development crew answer your questions, help you scout and source options, and investigate potential financial incentives for your upcoming shoot. Complete the form below, and someone will be in touch shortly.

Location Filming Inquiry

Tax Credits Programs

Ontario has some of the most competitive tax credit programs in Canada, positioning the Niagara Region and the province to better attract foreign productions while marketing the region as “film-friendly”.

There are both Federal and Provincial tax credit programs.

Canadian Film or Video Production Tax Credit, CPTC

To be eligible for the CPTC, the applicant must be a Canadian-owned, taxable corporation that is primarily in the business of Canadian film or video production. The CPTC is available at a rate of 25 per cent of the qualified labour expenditure.

Film or Video Production Services Tax Credit, PSTC

To be eligible for the PSTC, the applicant can be either a foreign-owned corporation or a Canadian-owned corporation that is primarily in the business of film or video production services. The PSTC is a tax credit equal to 16 per cent of salary and wages paid to Canadian residents or taxable Canadian corporations (for amounts paid to employees who are Canadian residents) for services provided to the production in Canada.

Provincial Tax Credits

Tax credit programs in the province of Ontario are administered by Ontario Creates in conjunction with the Canada Revenue Agency (CRA).

Ontario Film and Television Tax Credit

The OFTTC is a refundable tax credit based upon eligible Ontario labour expenditures incurred by a qualifying production company with respect to an eligible Ontario production. The OFTTC is generally “harmonized” with the Canadian Film or Video Production Tax Credit. The OFTTC is generally calculated as 35 per cent of the eligible Ontario labour expenditures incurred by a qualifying production company with respect to an eligible Ontario production.

Ontario Production Services Tax Credit

The Ontario Production Services Tax Credit (OPSTC) is a refundable tax credit based upon Ontario qualifying production expenditures (labour, service contracts and tangible property expenditures) incurred by a qualifying corporation with respect to an eligible film or television production. The OPSTC requirements are generally “harmonized” with the federal Film or Video Production Services Tax Credit administered by the Canadian Audio Visual Certification Office of the Department of Canadian Heritage (CAVCO) and Canada Revenue Agency (CRA). The OPSTC is calculated as 21.5 per cent of all qualifying production expenditures incurred in Ontario.

Ontario Computer Animation and Special Effects Tax Credit

The OCASE Tax Credit is a refundable tax credit based on eligible Ontario labour expenditures incurred by a qualifying corporation during a taxation year with respect to eligible computer animation and special effects activities. The OCASE Tax Credit may be claimed on eligible expenditures in addition to the Ontario Film and Television Tax Credit (OFTTC) or the Ontario Production Services Tax Credit (OPSTC). The OCASE Tax Credit is calculated as 18 per cent of the eligible Ontario labour expenditures incurred by a qualifying corporation with respect to eligible computer animation and special effects activities.

Ontario Interactive Digital Media Tax Credit

The Ontario Interactive Digital Media Tax Credit (OIDMTC) is a refundable tax credit based on eligible Ontario labour expenditures and eligible marketing and distribution expenses claimed by a qualifying corporation with respect to interactive digital media products. A 40 per cent tax credit is available for eligible Ontario labour expenditures and eligible marketing and distribution expenses incurred by qualifying corporations that develop and market their own products (known as “non-specified products”). The credit is 35 per cent on eligible Ontario labour expenditures for products developed under a fee-for-service arrangement (known as “specified products”). A 35 per cent credit on eligible labour expenditures is also available to qualifying digital game corporations and specialized digital game corporations (see large digital game corporations below).

Ontario Computer Animation and Special Effects Tax Credit

The OCASE Tax Credit is a refundable tax credit based on eligible Ontario labour expenditures incurred by a qualifying corporation during a taxation year with respect to eligible computer animation and special effects activities. The OCASE Tax Credit may be claimed on eligible expenditures in addition to the Ontario Film and Television Tax Credit (OFTTC) or the Ontario Production Services Tax Credit (OPSTC). The OCASE Tax Credit is calculated as 18 per cent of the eligible Ontario labour expenditures incurred by a qualifying corporation with respect to eligible computer animation and special effects activities.

Ontario Interactive Digital Media Tax Credit

The Ontario Interactive Digital Media Tax Credit (OIDMTC) is a refundable tax credit based on eligible Ontario labour expenditures and eligible marketing and distribution expenses claimed by a qualifying corporation with respect to interactive digital media products. A 40 per cent tax credit is available for eligible Ontario labour expenditures and eligible marketing and distribution expenses incurred by qualifying corporations that develop and market their own products (known as “non-specified products”). The credit is 35 per cent on eligible Ontario labour expenditures for products developed under a fee-for-service arrangement (known as “specified products”). A 35 per cent credit on eligible labour expenditures is also available to qualifying digital game corporations and specialized digital game corporations (see large digital game corporations below).

The Ontario Creates Film Fund is intended to increase the level of domestic feature film production in Ontario. It provides support to Ontario producers for feature film projects with development and production financing. Marketing and Distribution support is also available for films that have been supported via Film Fund-Production.